Now that 2024 has come to a close, Southern Maine’s multifamily real estate market tells a story of resilience and growth. From shifting buyer demands to fluctuating interest rates, this year brought a mix of challenges and opportunities for landlords, investors, and real estate professionals. We’ll recap the key trends, market data, and noteworthy transactions that defined the multifamily market in Southern Maine throughout 2024.

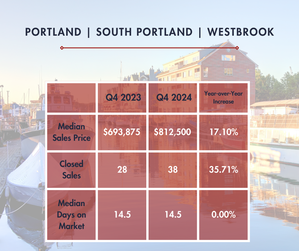

Cumberland County

If we look at the major multi-family markets in Cumberland County, you can see that we have seen some very strong appreciation. Median price is up by 17% year over year. We often advise our clients that the higher prices for multi-families in the Portland area mean that the cash flow will not be as strong. However, the potential for appreciation is greater than some other markets in Southern Maine. That definitely turned out to be the case in 2024.

If we drill down to the Westbrook market, we are seeing a 24.7% jump in the median price for multi-families. It is a small sample set as only 6 buildings closed in each Q4 for 2023 and 2024. This is still a sign that investors who are looking to avoid rent control in Portland are choosing to invest in Westbrook. Anecdotally, we listed a duplex in Westbrook in the first week of January and it attracted dozens of showings and we received 9 offers.

Looking forward, we will continue to see a healthy level of appreciation in Cumberland County as interest rates stabilize but I anticipate 2025 to be lower than the 17% we saw in 2024 if the units transacted continues to increase.

Androscoggin County

The Lewiston/Auburn market is a great spot to invest if you are looking for cash flow. Medium- large multi-families trade regularly at roughly $100,000 per unit so the rents typically more than satisfy the 1% rule. The 1% rule is a shortcut for measuring if a building will cashflow quickly on the fly. It is used by determining if the monthly rent roll is at least 1% of the purchase price.

We had a client recently purchase a 9-unit for $750,000 with a monthly rent roll of almost $10,000 with room to increase. This transaction more than satisfies the 1% rule, is cash-flowing on day-1, and this is not an uncommon occurrence in Lewiston/Auburn.

Even with the advantages of cash flow, you still are getting the added benefit of a great level of appreciation in L/A. We saw an 11% increase year over year of the median sold price. I anticipate the appreciation number to increase this year. The number of units transacted is down 12% and, at the time of writing this, there are currently only 7 active multi-family properties listed in all of Lewiston/Auburn. This indicates a constricted supply which will drive up prices.

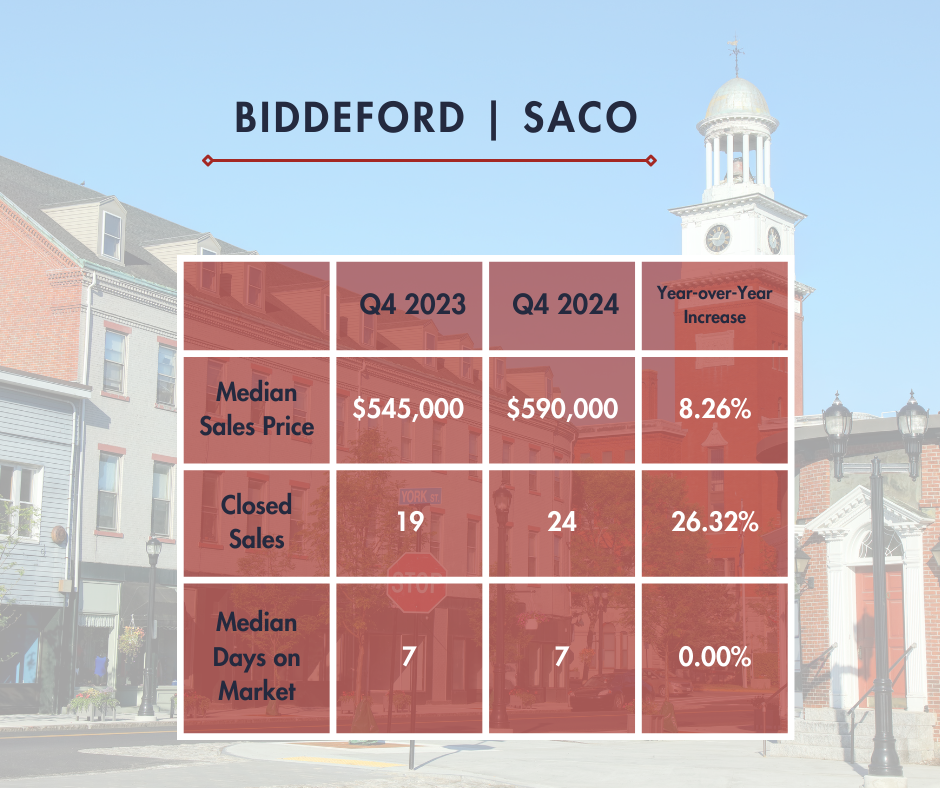

York County

We saw a little bit of a slow down in the Biddeford/Saco market. We only had 8% appreciation year over year. This is still a great number but not compared to previous years or to the Cumberland County market.

I believe the appreciation has slowed for 2 main reasons. The first is that we have had such a drastic increase in price over the past 5 years that we have finally reached more of a stabilized market. From 2020-2021 alone there was a 35% increase in the median price in Biddeford/Saco.

The second is that the pricing level has caught up to the market rents. In Q4 the average price per unit for 3 and 4 units was ~$195,000. If you apply the 1% rule the current rent roll would have to be $1,950 per unit for the building to cashflow. This is right around market rent for a 2-bedroom unit in Biddeford but there are many units that have long term tenants and are well below market.

I am still very bullish on Biddeford as a long term investment. There is a ton of development in the works that will continue to make it an attractive place for young people to live. The rental pool will continue to build and the rents will continue to increase. A condo conversion project was also just approved that will take 153 rental units off the market in the next 3 years. A lot of great tenants will be looking for rentals!